Our Commitment To

Responsible Investment and Asset Management Principles

Responsible Investment at Slate

We strive to align responsible investment principles with risk management and investment strategies to create long-term value for our stakeholders. By proactively managing risks, optimizing asset performance, and reducing environmental impact, we aim to position our investments to remain sustainable, resilient, efficient, and aligned with tenant and community needs.

We take a risk-aware, operationally focused approach to investment management, identifying themes and opportunities and capitalizing on them while staying true to our investment philosophy. We recognize that sustainability considerations are critical to this if we are to remain resilient and aligned with market and stakeholder expectations.

Therefore, we seek to enhance the resilience of investments by identifying and mitigating material risks whilst unlocking opportunities; drive operational efficiency through proactive asset management; and position investments for long-term value creation by integrating responsible investment principles into investment and asset management decision-making.

Our approach to investment and asset management is centered on creating value by integrating sustainability, risk management, and resilience into decision-making.

Our key focus areas include:

- Identifying and capitalizing on opportunities: we proactively assess emerging trends, evolving tenant needs, and the regulatory landscape to unlock value and drive innovation with sustainability considerations being embedded into this approach

- Managing climate and transition risks: assessing exposure and sensitivity to different physical and transition risks to help protect asset value through adaptation and mitigation

- Enhancing operational efficiency and asset resilience: leveraging data-driven insights to improve performance, resource consumption and future-proof investments and assets against changing demands

- Engaging with stakeholders and tenants: seeking opportunities to partner with tenants, local communities, and industry leaders to drive initiatives that enhance asset resilience and desirability

Bozena Jankowska

Managing Director, Global Head of Responsible Investment

“We understand the necessity of an adaptable responsible investment strategy that evolves with the changing landscape, enabling us to drive strong commercial outcomes while generating meaningful impact. This flexibility allows us to effectively navigate material sustainability risks and capitalize on emerging opportunities.”

Our Responsible Investment Strategy

Guided by our investment principles of Basis, Proactive, and Perspective, our responsible investment and sustainability strategy outlines how we integrate sustainability and risk management across each of our business verticals to support long-term value creation.

Basis

Proactive

Perspective

Sustainability is embedded in our investment and asset management approach, allowing us to anticipate and mitigate material risks. New investments undergo comprehensive due diligence, including an evaluation of environmental, climate-related, social, and governance risks, which are reviewed by the Investment Committee. Our asset management teams work to manage and mitigate identified risks, ensuring alignment with our commitment to sustainability, long-term asset resilience, and value creation.

We actively monitor the performance of our investments by tracking material sustainability factors and key performance indicators (KPIs). We develop customized scorecards to measure progress, identify areas for improvement, and enhance operational efficiency at the fund and asset levels.

Our fund-level sustainability goals are aligned with investment objectives and investor requirements to ensure materiality and relevance. These objectives are incorporated into sustainability management plans, including decarbonization strategies, outlining clear short-, medium-, and long-term actions to enhance asset performance while ensuring alignment with investment goals.

Basis

Sustainability is embedded in our investment and asset management approach, allowing us to anticipate and mitigate material risks. New investments undergo comprehensive due diligence, including an evaluation of environmental, climate-related, social, and governance risks, which are reviewed by the Investment Committee. Our asset management teams work to manage and mitigate identified risks, ensuring alignment with our commitment to sustainability, long-term asset resilience, and value creation.

Proactive

We actively monitor the performance of our investments by tracking material sustainability factors and key performance indicators (KPIs). We develop customized scorecards to measure progress, identify areas for improvement, and enhance operational efficiency at the fund and asset levels.

Perspective

Our fund-level sustainability goals are aligned with investment objectives and investor requirements to ensure materiality and relevance. These objectives are incorporated into sustainability management plans, including decarbonization strategies, outlining clear short-, medium-, and long-term actions to enhance asset performance while ensuring alignment with investment goals.

Basis

Proactive

Perspective

Integrated risk management is central to our credit investment strategy. We conduct ESG due diligence as part of the credit evaluation process, applying a tailored approach to assess material, credit-specific ESG risks and opportunities that could impact investment outcomes.

We monitor the material ESG characteristics of our credit investments to assess and manage risks that could affect collateral performance and portfolio resilience. As regulatory and market conditions evolve, we remain well-positioned to navigate emerging financial and sustainability-related risks.

By capturing key ESG metrics on individual credit investments, we stay attuned to market shifts and opportunities to develop innovative credit solutions that aim to support borrowers in transitioning their assets to a lower-carbon, more resilient future.

Basis

Integrated risk management is central to our credit investment strategy. We conduct ESG due diligence as part of the credit evaluation process, applying a tailored approach to assess material, credit-specific ESG risks and opportunities that could impact investment outcomes.

Proactive

We monitor the material ESG characteristics of our credit investments to assess and manage risks that could affect collateral performance and portfolio resilience. As regulatory and market conditions evolve, we remain well-positioned to navigate emerging financial and sustainability-related risks.

Perspective

By capturing key ESG metrics on individual credit investments, we stay attuned to market shifts and opportunities to develop innovative credit solutions that aim to support borrowers in transitioning their assets to a lower-carbon, more resilient future.

Basis

Proactive

Perspective

Our infrastructure strategy prioritizes essential and sustainable infrastructure investments that support cities and communities. By employing a materiality-based approach, we assess the most relevant ESG risks and opportunities within each sector to guide responsible investment decisions.

To measure our impact, we select key performance indicators (KPIs) and utilize ESG scorecards to track and monitor the sustainability performance of infrastructure assets and companies. This data-driven approach helps ensure alignment with market and regulatory expectations.

As the world transitions toward a lower-carbon, more sustainable future, our infrastructure investments focus on delivering essential, resilient infrastructure that supports long-term economic and environmental sustainability.

Basis

Our infrastructure strategy prioritizes essential and sustainable infrastructure investments that support cities and communities. By employing a materiality-based approach, we assess the most relevant ESG risks and opportunities within each sector to guide responsible investment decisions.

Proactive

To measure our impact, we select key performance indicators (KPIs) and utilize ESG scorecards to track and monitor the sustainability performance of infrastructure assets and companies. This data-driven approach helps ensure alignment with market and regulatory expectations.

Perspective

As the world transitions toward a lower-carbon, more sustainable future, our infrastructure investments focus on delivering essential, resilient infrastructure that supports long-term economic and environmental sustainability.

Basis

Proactive

Perspective

At Presima, ESG considerations are integrated into the security valuation process. Presima believes that there is a positive link between ESG risk management and cost of capital in real estate and uses dedicated ESG research providers to track ESG risk metrics across its coverage universe. Presima ensures all its employees stay informed of emerging ESG considerations and trends through regular education sessions.

A cornerstone of Presima’s investment process is engagement with companies in its investment universe on ESG matters, aiming to motivate them to enhance their operational practices. Presima also expresses engagement priorities through proxy voting, where research is actively conducted prior to engaging with the respective company on voting intensions. Presima’s ESG framework guides its approach to engagement. It incorporates research and metrics in efforts to influence added value to companies’ capital stock and benefit to shareholders and communities.

Presima is enhancing its carbon data collection process with the intention to improve accuracy in assessing the environmental impacts of its investments. Presima will develop a climate dashboard including key portfolio climate metrics. Climate-related regulations and policies are continuously evolving and impacting global REIT valuations, making it important to stay informed and to share the knowledge with all business verticals.

Basis

At Presima, ESG considerations are integrated into the security valuation process. Presima believes that there is a positive link between ESG risk management and cost of capital in real estate and uses dedicated ESG research providers to track ESG risk metrics across its coverage universe. Presima ensures all its employees stay informed of emerging ESG considerations and trends through regular education sessions.

Proactive

A cornerstone of Presima’s investment process is engagement with companies in its investment universe on ESG matters, aiming to motivate them to enhance their operational practices. Presima also expresses engagement priorities through proxy voting, where research is actively conducted prior to engaging with the respective company on voting intensions. Presima’s ESG framework guides its approach to engagement. It incorporates research and metrics in efforts to influence added value to companies’ capital stock and benefit to shareholders and communities.

Perspective

Presima is enhancing its carbon data collection process with the intention to improve accuracy in assessing the environmental impacts of its investments. Presima will develop a climate dashboard including key portfolio climate metrics. Climate-related regulations and policies are continuously evolving and impacting global REIT valuations, making it important to stay informed and to share the knowledge with all business verticals.

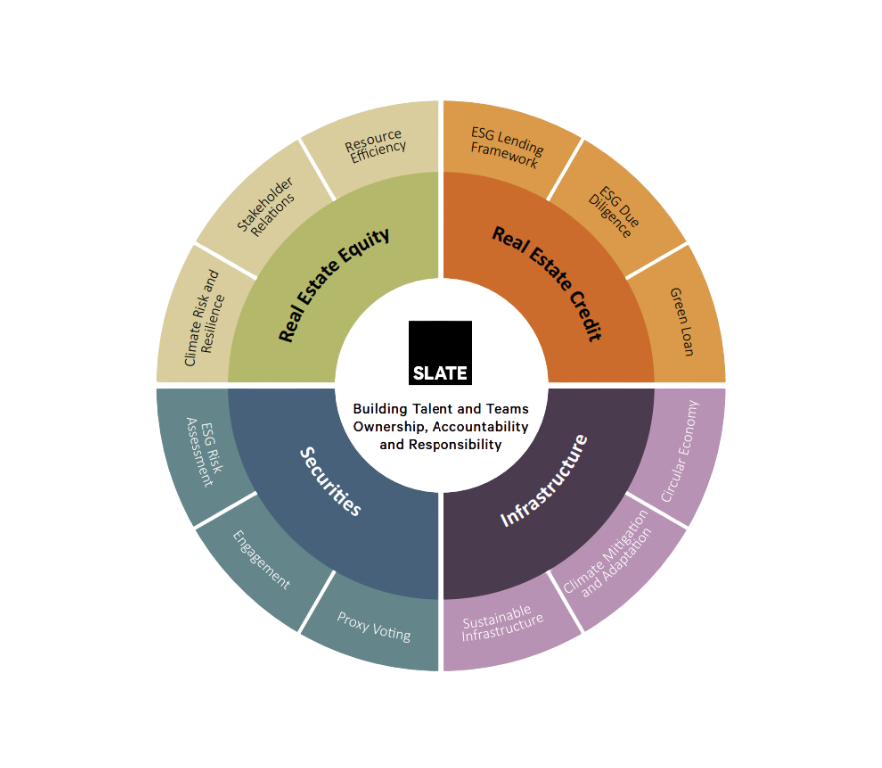

Sustainability Driven Opportunities Across Our Business

Assessing and understanding material sustainability topics across each business vertical is essential to crafting a meaningful and impactful responsible investment and sustainability strategy. By focusing on what truly matters, we can prioritize resources and efforts on areas that drive the most value – both commercially and sustainably. This approach enables us to align our strategies with stakeholder expectations and to enhance our ability to identify and manage risks, seize opportunities, and ensure that our sustainability initiatives are both relevant and impactful.

Responsible Investment Governance and Oversight

Slate’s sustainability and responsible investment governance is structured to ensure accountability and integration within investment and asset management.

1

Strategy Committee

Provides strategic oversight on integration of responsible investment principles across business lines and reviews material risks and opportunities to align sustainability objectives with long-term investment objectives.

2

Investment Committee

Reviews and ensures ESG due diligence considerations are incorporated into investment decisions.

3

Portfolio Managers & Asset Management Teams

Responsible for assessing and managing sustainability risks and opportunities throughout the investment lifecycle and implementing sustainability initiatives that enhance asset resilience, efficiency, and long-term value.

4

Sustainability Champions

Play a key role in driving and implementing sustainability initiatives within their areas of operation, ensuring alignment with investment and asset management priorities.

Affiliations and Partnerships

Slate engages with the following sustainability frameworks and organizations to thoughtfully advance all firmwide environmental, social, and government efforts.

Slate became a member of GRESB in 2022, which has allowed us to have a comprehensive and consistent way of understanding, measuring, and improving the environmental, social, and governance (ESG) performance of our funds against peers.

Slate became a UN PRI signatory in 2024 and publicly committed to incorporating responsible investment principles into our investment decision making and ownership practices.